Tax 179 Deduction 2025. In 2025 (taxes filed in 2025), the section 179 deduction is limited to $1,220,000. There also needs to be sufficient.

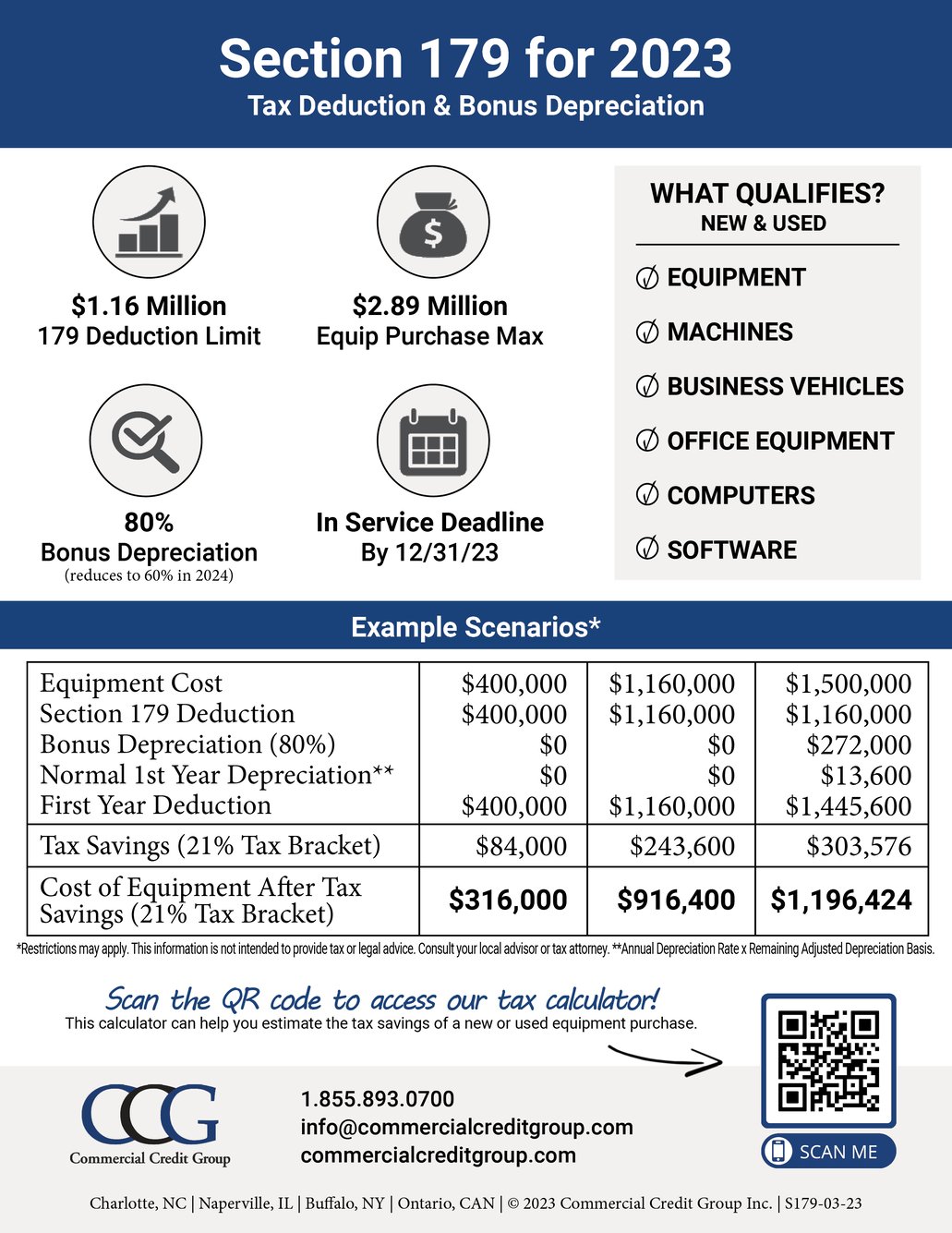

101 rows 2025 list of vehicles over 6,000 lbs that may qualify for a section 179 deduction. The total available deduction increased from $1,080,000 to $1,160,000, meaning you can deduct up to that amount on your taxes.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year.

Section 179 IRS Tax Deduction Updated for 2025, $24,000 (60% of the purchase price over. Once a business has bought assets valued in.

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, The limit for the section 179 deduction for 2025 is $1.22 million, with a phaseout on the amount that can be deducted beginning at $3.05 million of total eligible. Subsystems eligible included interior lighting,.

Section 179 Tax Deductions Infographic GreenStar Solutions, In 2025, the section 179 deduction limit for qualifying equipment purchases is. Previously, up until the end of 2025, these vehicles enjoyed a.

Section 179 Deduction Non Qualifying Property Understanding The, $24,000 (60% of the purchase price over. Previously, up until the end of 2025, these vehicles enjoyed a.

Calculate your potential Section 179 Tax Deductions on New Equipment, The thresholds for savings range from a minimum of 25% to a maximum of 50%. Limitations and thresholds for section 179 deduction as per irs in 2025.

section 179 calculator, In 2025 (taxes filed in 2025), the maximum section 179 deduction limit is not yet available. Under the 2025 version of section 179, the deduction threshold in terms of the value of new equipment purchases is $3,050,000.

Section 179 Tax Deduction What Does It Mean For Your Business, The maximum deductible amount begins to decrease if more than $3,050,000 worth of property is placed in. Thirdly, there is a limit as to how much can be deducted under section 179.

Section 179 Tax Deduction, The section 179 deduction limit for tax year 2025 is $1,160,000 with an investment limit of $2,890,000. Previously, up until the end of 2025, these vehicles enjoyed a.

Section 179 Tax Deductions Infographic GreenStar Solutions, Once businesses spend more than. $1,220,000 (the maximum for 2025) bonus deduction:

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Section 179 tax deduction limit for 2025. Once a business has bought assets valued in.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year.